(Bloomberg) — A three letter acronym is increasingly cropping up in corporate filings and it’s fueling concern among ratings companies and fund managers.

Most Read from Bloomberg

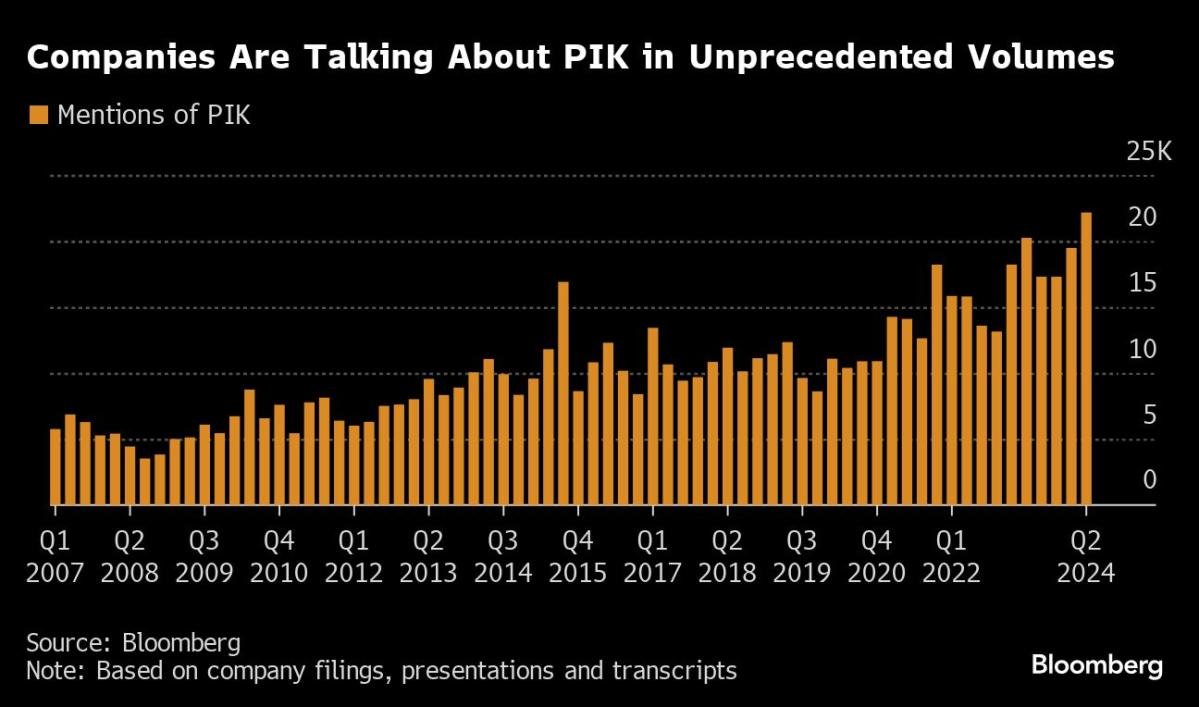

Mentions of PIK in company filings, presentations and transcripts have doubled since the start of the pandemic, according to data compiled by Bloomberg. Short for ‘payment in kind,’ the term refers to debt that allows companies the option of deferring interest payments.

PIK obligations often amount to hidden leverage for companies, as delayed interest gets tacked on to principal due. The debt has proven particularly attractive to private equity firms, who have been hit by lower valuations and higher borrowing costs after largely failing to hedge against the risk of rising interest rates.

While deferring interest payments for a couple of quarters can help sidestep short-term cash squeezes, extended delays of payments makes it harder to refinance debt piles. That, in turn, is worrying regulators, who fret about the ways in which private credit funds, which can be providers of PIK debt, could impact the financial system.

“Lenders have a number of ways they can mask liquidity challenges with their underlying borrowers,” said Ted McNulty, chief investment officer at MidCap Financial Investment Corp., a middle-market lender managed by an affiliate of Apollo Global Management Inc., on a call with analysts earlier this month. “Whether at origination or as part of the restructuring, PIK income is a proxy for borrowers who cannot currently service their debt.”

PIK makes up 6.7% of income among private credit funds at present, up from 5.4% a year ago, according to Ana Arsov, global head of private credit at Moody’s Ratings, who added that it’s not a sustainable strategy because it creates a permanently heavy debt structure.

PIK is a “a way of buying time for distressed credits as they await rate cuts,” she said, adding it “masquerades fund performance for investors.”

Others say that it’s important to look deeper and see what the plan is for the borrowings.

“You have to differentiate between PIK that is intentional at the outset versus maybe PIK that is used to reduce default,” Michael Arougheti, chief executive at Ares Management Corp., said in a recent earnings call. “If you are thinking about prudently structuring your leverage” and don’t want to constrain a company’s “growth plan, then PIK is the way that you are going to capture excess return and support your borrowers.”

The number of documents mentioning PIK debt rose about 240% over the last five years among business development companies’ filings, presentations and transcripts. Prospect Capital Corp. stands out among them for using the term over 400 times in documents, almost four times as much as the second-ranked. One-third of the net investment income the Prospect fund generated in 2023 was paid in kind, double the industry average, according to Fitch Ratings.

Prospect Capital didn’t return a request for comment on Friday. But in a statement posted on its website last week, the firm said PIK “can be an efficient funding mechanism” when “companies are making accretive investments in their business with valuations substantially above Prospect’s cost basis.”

Week in Review

-

The stock and bond markets are sending different signals about the likelihood of a US recession, leading some major investors to say there is too much complacency in credit.

-

Bets on bigger interest-rate cuts by major central banks are boosting the attractiveness of ultra-short commercial debt for some of the world’s biggest companies.

-

China’s push to tamp down a rally in government bonds is beginning to take a toll on corporate debt markets.

-

Mars Inc. has lined up the biggest blue-chip debt financing for a merger and acquisition in nearly a year to help finance its $36 billion purchase of Kellanova.

-

KKR & Co. is in the early stages of plans to finance its acquisition of public relations firm FGS Global with about $500 million of debt from private credit lenders.

-

Many investors have been hit by a downturn in China’s equity-linked bonds, a market now gripped by fears of default.

-

Investors that bet billions on mortgage-backed bond returns beating investment-grade corporate debt have been waiting all year for their payoff. Last week’s bout of volatility briefly vindicated their positions and some see that a full victory may not be far off.

-

Asian high-yield dollar bonds have room to rally even after delivering more than double the return of their global peers this year, money managers say.

-

Moody’s cut China Vanke Co.’s debt rating deeper into junk territory, underscoring mounting pressure on the state-backed developer as it faces a cash crunch and declining sales.

-

Billionaire Charles Koch’s closely held company is cashing in on the appetite of individuals for one of the riskiest corners of the loan market — CLO equity.

-

AT1s have charted a nearly uninterrupted rebound from one of the most dramatic blow-ups the credit market has ever seen. That’s left some yearning for more drama.

-

Apollo Global Management Inc.’s Brightspeed reached a deal with a group of lenders to slash $1.1 billion of the telecom company’s debt and receive $3.7 billion of new capital.

-

JetBlue Airways Corp. priced $2.77 billion of bonds and loans after the recently downgraded carrier shifted the deal structure further into notes.

-

Kroger Co. plans to sound out investors for a possible multi-part bond sale and has begun an exchange offer for debt issued by takeover target Albertsons Cos., as antitrust scrutiny looms over the potential tie-up.

On the Move

-

Dwight Scott, who helped build Blackstone Inc.’s credit operation into a $330 billion behemoth, is retiring from the firm.

-

DWS, the asset management unit of Deutsche Bank AG, hired Jay DeWaltoff, Daniel Sang, Catherine Millane and Khrystyna Bazylyak from JPMorgan’s asset management arm to help expand its US real estate credit business and private credit platform.

-

KKR & Co. appointed three executives to top leadership roles at its Global Atlantic insurance business. Billy Butcher, a partner at KKR, has been tapped to be CFO of the insurance unit, while partners Brian Dillard and John Reed will be co-CIOs.

-

National Bank of Canada’s co-head of US fixed income sales & trading, Noel Heavey, has left the firm.

-

Bank of America Corp. named Lyndsay Langford as Canada head of its Global Payments Solutions business.

-

Mitsubishi UFJ Financial Group Inc.’s Asia securities arm has hired Evren Cakirahmetoglu as its head of Asia ex-Japan credit flow trading.

-

Banco Bradesco SA, Brazil’s third-biggest bank by market value, hired Gabriel Trebilcock, one of the founding partners of hedge fund Ace Capital, to head its local credit sales and trading desk as the lender aims to double the business in two years.

-

Alvarez & Marsal Inc. plans to expand its Australian headcount by more than half amid expectations that rising interest rates and subdued economic growth will drive more companies into financial difficulties.

-

Bank of Nova Scotia has recruited a team of seven from JPMorgan Chase & Co. in Texas to launch a new mortgage capital markets business in Houston. Thanh Roettele, who’s worked at JPMorgan for over 28 years, will join as one of three managing directors on the new team. The other two are Brice Simpson and Francis Lim.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.