(Bloomberg) — Stocks rose and bond yields fell, with the latest Federal Reserve minutes and a big downward revision of US payrolls reinforcing bets officials will cut rates in September.

Most Read from Bloomberg

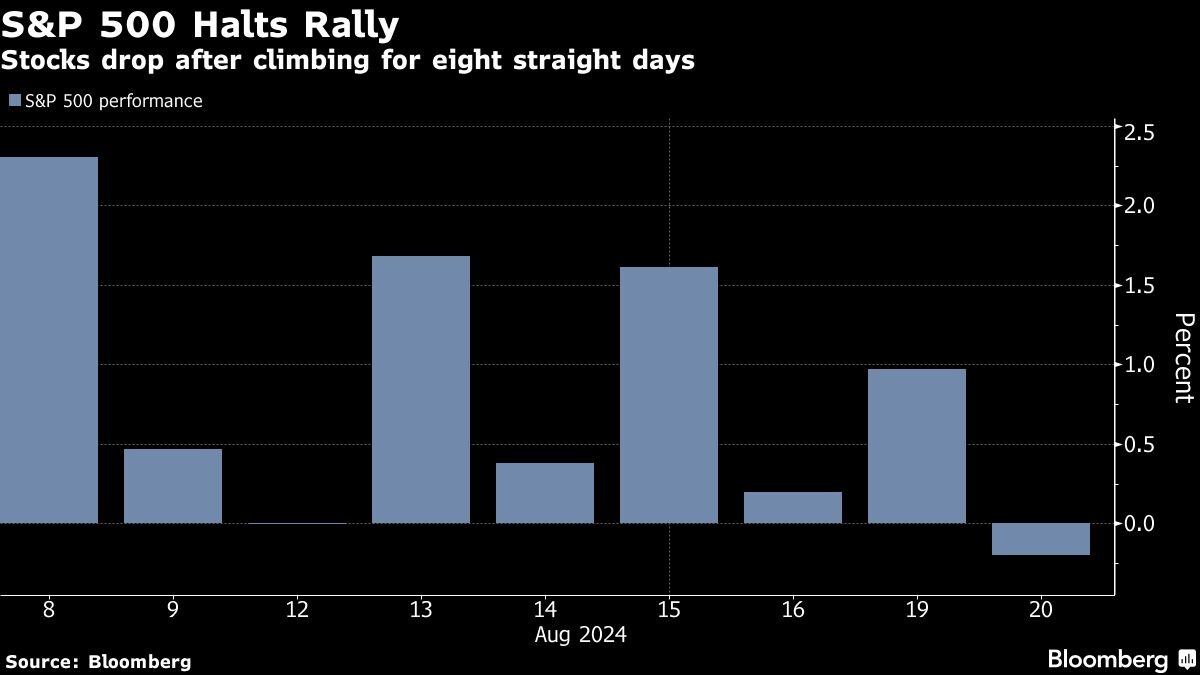

The S&P 500 came closer to its all-time highs. Treasuries climbed across the curve, with the move led by shorter maturities. Swaps are pricing in about 100 basis points worth of easing in 2024. The implied rate on the contracts show traders expect a quarter-point cut next month — and a roughly 20% chance for a half-point reduction.

In the run-up to Jerome Powell’s Friday speech in Jackson Hole, traders are scouring minutes from the latest Fed policy meeting. Several Fed officials acknowledged there was a plausible case for cutting rates at their July meeting before the central bank’s policy committee voted unanimously to keep them steady.

“The Fed minutes removed all doubt about a September rate cut,” said Jamie Cox at Harris Financial Group. “The Fed’s communication strategy is to make its meetings less of a market moving event, and they are following the script to the letter.”

To Bret Kenwell at eToro, with a “vast majority” of Fed members viewing a September rate cut as appropriate before the disappointing monthly jobs report, it seems all but certain that the Fed will cut next month.

“The question isn’t whether the Fed will cut rates in September, but rather, how much will the Fed cut?” he said. “The market is currently pricing in greater odds of a 25 basis point cut rather than a 50 basis point cut, which seems like the more likely outcome at this point, provided the August jobs report isn’t a drastic disappointment.”

Treasury 10-year yields declined four basis points to 3.77%. The S&P 500 hovered near 5,620. Target Corp. climbed 11% after ending a string of sales declines in the second quarter, citing improved discretionary spending. Macy’s Inc. slightly missed estimates for its quarterly revenue and lowered its outlook for sales during the rest of the year.

Oil extended its decline to the lowest in more than six months as trend-following algorithmic sellers overlooked a bullish US stockpile report.

While the annual revision to jobs growth wouldn’t usually impact trading, it got attention this time around due to the recent concern the labor market is cooling too much amid high rates. The number of workers on payrolls will likely be revised down by 818,000 for the 12 months through March. It was the largest downward revision since 2009.

“The main message from the revisions in my mind is reinforce just how ‘silly’ it is to let the next jobs number be the determinant in whether to go 25 or 50 in September,” said Neil Dutta at Renaissance Macro Research. “What this revision data imply is that whatever the next jobs number is going to be, it’s probably lower in reality.”

Krishna Guha at Evercore says the big payroll revisions will reinforce the Fed’s assessment that the labor market has been softening under restrictive policy and that it will need to recalibrate rates in a timely manner to prevent this from extending further than desired.

All this favors a relatively “low bar” for 50 basis-point rate cuts. The base case remains a string of 25 basis-point moves.

At Strategas, Don Rissmiller says the case for lower policy rates got stronger. The Fed will need to validate this rate cut cycle – which likely means multiple cuts, he noted, pointing to Powell’s speech on Friday at Jackson Hole.

To Jennifer McKeown at Capital Economics, central bankers are unlikely to offer much forward guidance at the Jackson Hole symposium, preferring to stress their “data dependence.”

“Since most economies are expanding, inflation is easing back to target and financial markets have stabilized after the recession scare a few weeks ago, there is less pressure for them to steer markets than there has been around past events,” she noted. “But they risk keeping rates too high for too long.”

With the Fed poised to cut interest rates from restrictive levels and still strong economic and earnings fundamentals, the the environment remains supportive for stocks, with still strong economic and earnings fundamentals, and a Fed poised to cut interest rates from restrictive levels, according to Solita Marcelli at UBS Global Wealth Management.

“Our base-case year-end and June 2025 S&P 500 price targets remain 5,900 and 6,200, respectively,” she noted.

Marcelli believes quality growth remains well placed to outperform. Firms with competitive advantages and exposure to structural drivers should be better positioned to grow and reinvest earnings consistently, she noted.

Corporate Highlights:

-

Ford Motor Co. is recalibrating its electrification strategy yet again, canceling plans for a fully electric sport utility vehicle in a shift that may cost the carmaker around $1.9 billion.

-

Walmart Inc. raised about $3.6 billion by selling its stake in Chinese e-commerce firm JD.com Inc., winding down an eight-year partnership that appears to be paying diminishing returns amid a challenging landscape for Chinese tech giants.

-

US coal producer Consol Energy Inc. agreed to merge with Arch Resources Inc. in a $2.3 billion deal as the transition to greener fuels threatens the industry’s long-term outlook.

-

Brookfield Asset Management is asking banks to line up about €9.5 billion ($10.6 billion) of debt for its potential take-private deal for Spanish pharmaceutical producer Grifols SA, according to people with knowledge of the matter.

Key events this week:

-

Eurozone HCOB PMI, consumer confidence, Thursday

-

ECB publishes account of July rate decision, Thursday

-

US initial jobless claims, existing home sales, S&P Global PMI, Thursday

-

Japan CPI, Friday

-

BOJ’s Kazuo Ueda to attend special session at Japan’s parliament to discuss July hike, Friday

-

US new home sales, Friday

-

Jerome Powell speaks in Jackson Hole, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 rose 0.4% as of 2:47 p.m. New York time

-

The Nasdaq 100 rose 0.4%

-

The Dow Jones Industrial Average rose 0.1%

-

The MSCI World Index rose 0.5%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro rose 0.3% to $1.1163

-

The British pound rose 0.6% to $1.3107

-

The Japanese yen rose 0.3% to 144.78 per dollar

Cryptocurrencies

-

Bitcoin rose 2.1% to $60,536.98

-

Ether rose 1.6% to $2,631.75

Bonds

-

The yield on 10-year Treasuries declined three basis points to 3.77%

-

Germany’s 10-year yield declined two basis points to 2.19%

-

Britain’s 10-year yield declined two basis points to 3.89%

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.