- Bitcoin miners were accumulating the coin for over a month.

- BTC gained bullish momentum in the last 24 hours as its value surged by 4%.

Bitcoin [BTC] halvings have been one of the most prominent events in the history of cryptos, as they play a crucial role in shaping BTC’s future. After each halving, BTC took its time to gain bullish momentum and reach new highs.

Since the last halving happened a few months ago, AMBCrypto planned to check whether BTC has been following its past trend.

What are Bitcoin miners up to?

Ali, a popular crypto analyst, recently posted a tweet mentioning interesting information related to BTC halving cycles.

As per the tweet, it’s been 119 days since the 2024 Bitcoin halving. In the last two cycles, BTC hit a market top around 530 days post-halving. If BTC follows a similar trend, then this just might be the early stages of BTC’s bull cycle.

Since the halving, BTC’s hashrate has been pretty stable. This meant that miners were continuing their operations at a steady pace. At press time, BTC’s hashrate stood at 602.28 EH/s.

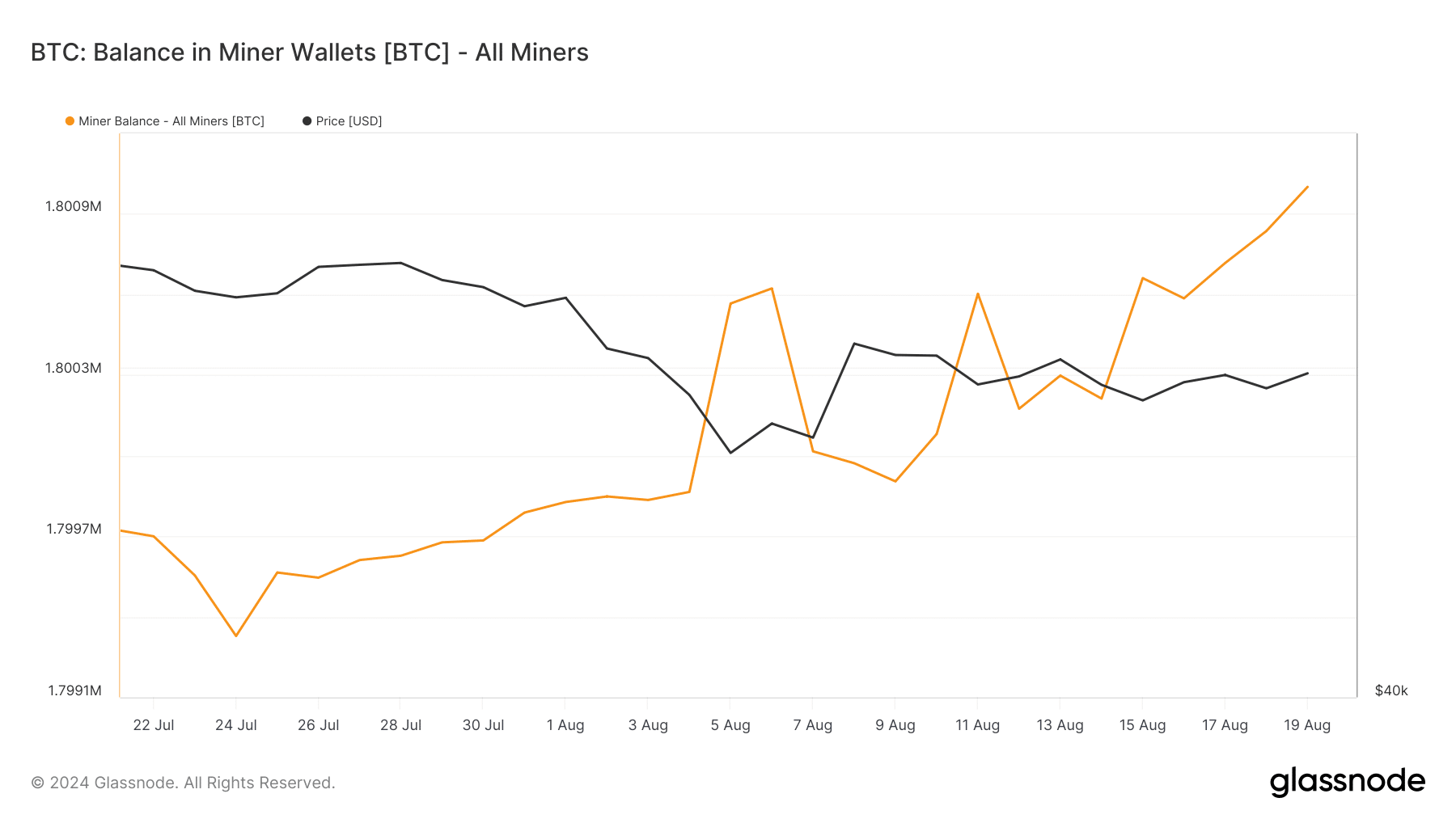

AMBCrypto planned to have a look at Glassnode’s data to find out how BTC miners were behaving. As per our analysis, BTC miners’ revenue has been on a declining trend for the last 30 days.

However, it was surprising to see a considerable rise in miners’ balance during the same period. This clearly meant that miners were accumulating BTC as they hoped for a price increase.

Additionally, CryptoQuant’s data also revealed that BTC’s Miners’ Position Index was green, indicating that miners were selling fewer holdings compared to its one-year average.

Reason behind miners’ accumulation

Since miners were stockpiling BTC, AMBCrypto took a look at other datasets to find out the possible reason behind this tactic.

The Bitcoin Rainbow Chart, an indicator that reveals BTC’s state in reference to its price, suggested that BTC was in the “accumulation” phase.

This meant that it was the right time to buy more before the coin’s price gained bullish momentum.

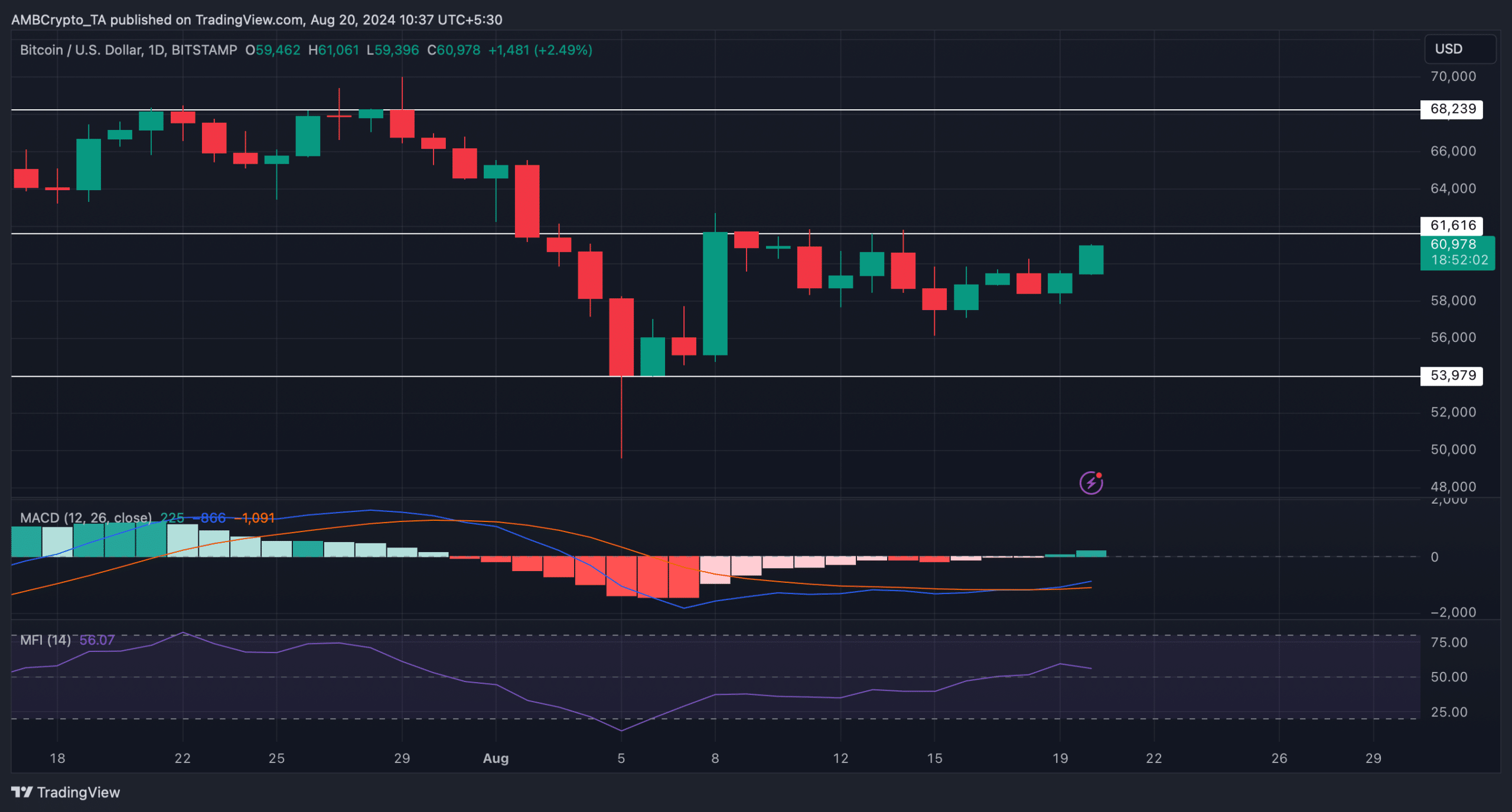

CoinMarketCap’s data revealed that BTC bulls entered the market in the last 24 hours as the coin’s price increased by 4%. At the time of writing, BTC was trading at $60,930.84 with a market capitalization of over $1.2 trillion.

AMBCrypto then assessed the coin’s daily chart to figure out whether this uptrend would last.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The technical indicator MACD displayed a clear bullish crossover, which meant that the chances of a continued price increase were high. Nonetheless, the Money Flow Index (MFI) registered a decline.

This indicated that investors might witness a few slow-moving days.